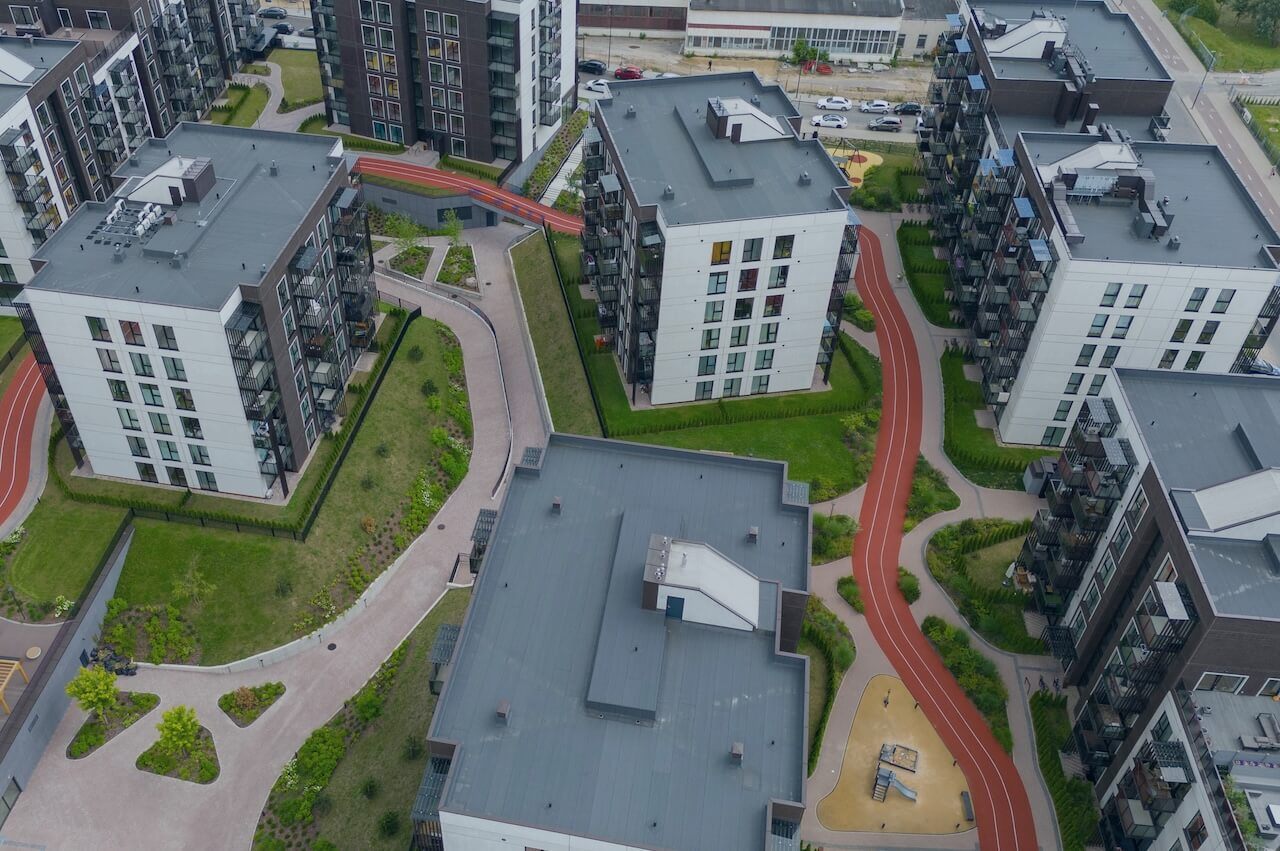

Rent collection remains one of the most vital—and vulnerable—metrics for multifamily property performance. Yet even well-performing assets can see sudden declines in rent payments when market conditions shift or tenant populations experience financial strain.

For asset managers and owners looking to avoid surprises, real-time insights into tenant credit behavior offer a new kind of advantage. The ability to anticipate risk before it materializes allows for more proactive decision-making and strategic portfolio oversight.

A new lens on tenant financial health

Traditional rent roll analysis often looks backward at missed payments or occupancy drops that have already occurred. When those issues appear in your reporting, it’s often too late to respond without consequence.

That’s where aggregated tenant credit insights come in.

WDSuite offers tenant credit insights that give multifamily professionals early visibility into residents' financial health at the property level. With this data in hand, you can detect signs of financial stress before they impact your bottom line.

What’s included in WDSuite’s tenant credit insights?

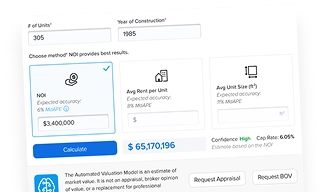

WDSuite aggregates anonymized consumer credit data and surfaces actionable metrics that reflect how financially stable—or strained—a tenant population is. Key indicators include:

- Average tenant credit scores, tracked over time

- Delinquency rates across credit obligations

- Credit utilization ratios that reflect financial pressure

Together, these signals form a powerful early warning system. A downward trend in credit scores or a spike in utilization, for example, can indicate rising risk, even if rent collection hasn’t yet declined.

A 30-point credit score drop can double default risk. Wouldn’t you want to know that before rents go unpaid?

Why tenant credit health insights matter more now than ever

With interest rates elevated and affordability stretched in many markets, tenant financial stability is increasingly variable from one asset to the next. Some properties may have strong-paying residents, while others, perhaps even in the same market, could be on shakier ground.

In analyzing buildings across dozens of U.S. metros, WDSuite data has revealed wide gaps in tenant credit profiles even within the same portfolio. A 30-point drop in average credit score at one asset, for instance, can double the risk of default compared to another property under the same ownership.

These disparities emphasize the importance of precision. Without granular insight, asset managers are often left reacting to symptoms rather than predicting causes.

Use cases for proactive asset management

Armed with tenant credit health insights, asset managers can:

- Flag at-risk properties early, even before rent payments are missed

- Tailor leasing strategies to fit tenant financial capacity

- Guide tenant engagement programs to support retention and payment behavior

- Support disposition or refinance decisions with tenant credit metrics

In short, this is about more than just identifying problems. It’s about making better decisions—faster, and with more confidence.

No more rent risk surprises

Rent collection surprises are rarely pleasant, but they’re not inevitable. With the right tools, multifamily professionals can move from reactive to predictive, managing risk with the same rigor they bring to underwriting or pricing strategy.

WDSuite’s tenant credit insights turn market uncertainty into actionable intelligence. For asset managers, that means one thing: control.

Want to know which assets are vulnerable-before rent becomes a problem? Start tracking tenant credit trends today with WDSuite.